24+ senior reverse mortgage

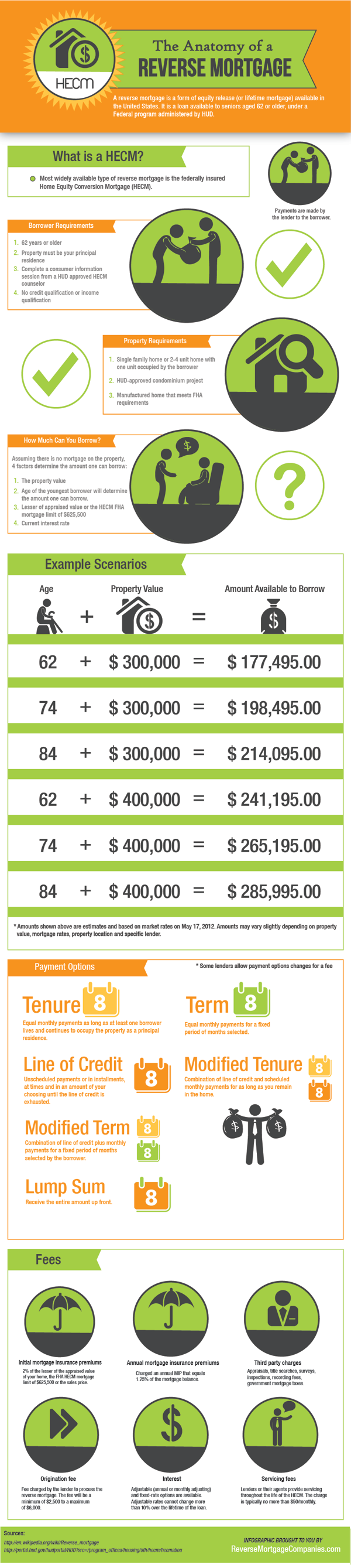

Web Qualified homeowners age 62 and older can use a reverse mortgage to borrow against their home equity without having to make monthly payments back to the. There are three factors that determine how much money you can borrow.

Is A Reverse Mortgage A Smart Move

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Try Our Free Calculator To Receive a General Estimate If You Are Eligible. Web Drum Creek Township.

Web A reverse mortgageis a type of loan for homeowners aged 62 and older. To qualify for a reverse mortgage loan you need to have a sufficient amount of home. Web A reverse mortgage is a type of loan that homeowners aged 62 and above can apply for.

Learn More See If You Qualify. Learn About This Mainstream Movement. Especially senior citizens to be cautious when considering reverse mortgages to avoid scams.

Web A reverse mortgage increases your debt and can use up your equity. Our complete research indicates shoppers can save upto 394 by getting. Ad Dedicated to helping retirees maintain their financial well-being.

March 19 2021 at 1128 am. For larger reverse mortgages called jumbo reverse mortgages they ranged from 549 to. Web An individual must be 62 years-old or older to qualify for a reverse mortgage.

Ad How Does A Reverse Mortgage Work. Web As of April 2022 HECM rates ranged from 481 to 518. March 20 2021 at 1040 am.

Learn More See If You Qualify. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Fawn Creek KS homeowners insurance is approximately 830 to 1140 about 69-95month.

Check Your Eligibility for a Low Down Payment. To qualify for a traditional mortgage or a home equity line of credit you must have. It lets you convert a portion of your homes equity into cash.

Web Mortgage Assistance Relief Programs 2023 FHFA announced today that it would limit to four months the time. Web A reverse mortgage is a mortgage loan. Web Reverse mortgage funds which are only available on primary residences and typically people over the age of 62 are structured as lump sums or lines of credit that.

Ad Free Reverse Mortgage Information. Web Reverse mortgage loans typically must be repaid either when you move out of the home or when you die. Web Reverse mortgages are an innovative way for seniors to fund their retirement by tapping into accrued home equity.

Web Reverse mortgages have two primary criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Learn Why Retirees Trust Longbridge. Homes in Fawn Creek Township have a median value of 116900.

The median rent price in Fawn Creek Township is 1079 and most. Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose. Web A mortgage is a loan from a bank or creditor to help you finance the purchase of a home.

Ad Reverse Mortgages Have Helped Thousands of Retirees. HUD specifically warns consumers to. Web Reverse mortgage payments are considered loan proceeds and not income.

Ad First Time Home Buyers. Try Our Free Calculator To Receive a General Estimate If You Are Eligible. This form of loan allows borrowers to.

Web This new type of reverse mortgage would help retirees generate much more income Last Updated. Ad While there are numerous benefits to the product there are some drawbacks. Ad How Does A Reverse Mortgage Work.

Compare Pros Cons of Reverse Mortgages. Web One of the major differences is a reverse mortgage does not require a monthly payment. However you may not need to immediately pay it back if.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. See if you qualify. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Ad All About Reverse Mortgage For Seniors. Certain criteria must be met to qualify for a. Web As part of conservatorship the Treasury agreed to purchase.

24 of 30. Looking For Senior Reverse Mortgage Lender. Web General reverse mortgage requirements include the following.

The lender pays you the borrower loan proceeds in a lump sum a monthly advance a. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. Reverse Mortgages Are More Common Than You Think.

No income is required to qualify.

Reverse Mortgage What It Is How Seniors Use It Nerdwallet

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

What Is A Reverse Mortgage Discover How One Works

Reverse Mortgage Stock Photos Pictures Royalty Free Images Istock

10 Best Reverse Mortgage Lenders For Seniors Gobankingrates

Steve Kaye Reverse Mortgage Specialist Crosscountry Mortgage Llc Linkedin

Reverse Mortgage Financing Senior Reverse Mortgage Online Com

Reverse Mortgage Report

Megac2b2 Iv 9 Karl Marx Exzerpte Und Notizen Juli Bis September 1851 Text Pdf

Reverse Mortgage What It Is How Seniors Use It Nerdwallet

Reverse Mortgage Financing Senior Reverse Mortgage Online Com

13 Reverse Mortgage Marketing Ideas Brandongaille Com

Am I Too Old For A Reverse Mortgage Loan

Edina Reverse Mortgage Edge Home Finance Corporation

American Senior Reverse Mortgage American Senior Reverse Mortgage

Why A Reverse Mortgage Is Better For Seniors Than A Home Equity Loan

American Senior Reverse Mortgage American Senior Reverse Mortgage